Navigating the complexities of real-estate taxes can be challenging, especially with growing rules and elaborate calculations. For investors , rental property tax software , or real estate professionals, keeping on top of tax needs is not just necessary to prevent penalties but also to maximise profitability. Listed here is wherever leveraging modern technology can improve your efforts and eliminate financial stress.

Real estate tax computer software is more than a digital instrument; it's a game-changer for coordinating, calculating, and filing your fees seamlessly. By automating repetitive procedures and providing tailored characteristics, the proper application empowers users to handle their finances with precision.

The Importance of Real Estate Tax Software

Correct tax confirming is non-negotiable in actual estate. From mortgage deductions to advantage depreciation, lacking out on these opportunities can considerably influence your base line. Tax software made specifically for property targets these intricacies, ensuring you declare what's actually yours while remaining certified with tax laws.

Reports reveal that applying tax software can reduce errors by over 30% compared to information filing. This is because these programs are constructed with algorithmic detail, giving regular and error-free calculations. Also, adding automation into your economic workflow preserves a lot of time that will usually be used poring around types and receipts.

Key Features to Look for in Top Real Estate Tax Solutions

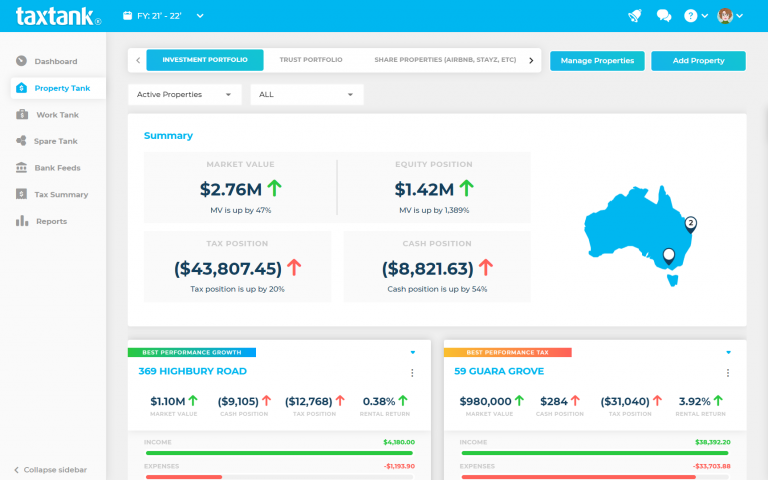

When choosing the right tax computer software to simplify your finances, prioritize characteristics that appeal to real estate-specific needs. Opt for options offering money and expense monitoring for your qualities, computerized depreciation calculations, and the capacity to make comprehensive tax reports. These functionalities assure you have a holistic view of your finances at any moment.

Cloud-based entry is still another essential factor, specially in the present dynamic qualified landscape. Having protected, mobile-friendly tax software lets you view and upgrade financial documents wherever you are, ensuring last-minute changes or additions never find you off guard.

Simplifying Tax Season

Late filings, overlooked deductions, and sudden penalties usually problem real-estate experts who opt to deal with taxes manually. By adopting tax pc software, you get satisfaction knowing your filings are reasonable and accurate. Furthermore, several contemporary resources include straight with sales tools, lowering redundant data access and the danger of oversights.

Simplifying your finances and increasing tax accuracy isn't only fascinating; it's becoming important in a business where performance translates directly to profitability. Equip your self with the proper instruments and take demand of one's real-estate tax obligations effortlessly.