Handling real-estate taxes can often experience frustrating, with complicated calculations, moving regulations, and the constant pressure to reduce liabilities. But in today's electronic age , property tax software is emerging as a strong instrument to help home homeowners, investors, and corporations improve tax software for rental property while saving money.

Why Real Estate Tax Software is a Game-Changer

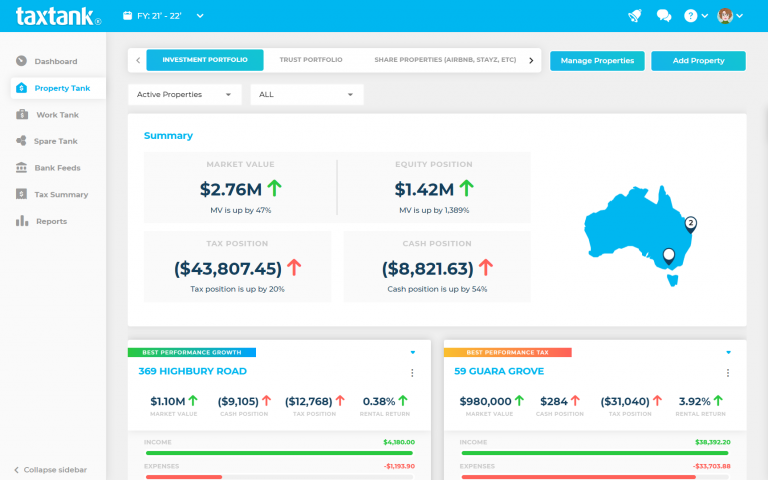

New data highlight the substantial economic advantages of leveraging advanced technology for tax management. In accordance with surveys, businesses that follow automated tax solutions record up to and including 20% reduction in preparation and filing errors. These errors not only charge time but often result in penalties that may have been avoided. By reducing information functions and individual problems, real estate tax pc software guarantees better reliability and compliance.

Moreover, property owners can improve deductions and find overlooked opportunities for savings. Many platforms now use sophisticated methods to automatically recognize and classify deductible expenses, such as for instance depreciation, maintenance costs, and curiosity payments. With tax auditors citing imperfect or incorrect deductions among the top factors for audits, the ability to enhance precision becomes invaluable.

Key Benefits of Using Real Estate Tax Software

Among the most amazing options that come with contemporary tax computer software is its power to incorporate with current systems. Whether controlling numerous attributes or perhaps a single hire system, people can quickly monitor money, costs, and duty liabilities in real-time. Computerized confirming characteristics more encourage people by providing apparent ideas within their tax situation, enabling positive preparing ahead of tax season.

Still another critical advantage is remaining up-to-date with moving tax regulations. Laws bordering property fees are constantly growing, and missing key improvements can lead to costly compliance issues. Tax software services usually upgrade their systems immediately to reflect the newest rules and duty codes, ensuring that users remain informed and compliant.

Concurrently, in regards to audits, having arranged and easily accessible documentation is crucial. Real-estate tax application helps keep centralized documents, reducing the chaotic last-minute scramble for statements or documentation.

Take Control of Your Tax Strategy

Property tax application offers significantly more than convenience; it presents users a substantial edge in optimizing savings, increasing conformity, and simplifying the frustrating job of tax management. By adopting that cutting-edge engineering, home homeowners and firms can give attention to development while leaving the burden of calculations and compliance to a trusted, computerized system.