Web Running Money (NOI) is one of the most essential metrics utilized in property to determine the profitability and performance of a property. Whether you're an investor assessing potential buys or home owner seeking to improve returns, understanding NOI can offer valuable ideas into how properly a rental increase letter house is performing. Here is a closer search at its significance and application.

What's NOI ?

NOI shows the total income a property provides following subtracting functioning expenses but before subtracting taxes, mortgage payments, or different financing costs. It essentially procedures the property' ;s capability to generate revenue from its procedures alone. For example, if home gets $100,000 in rents and incurs $30,000 in functioning charges, its NOI would be $70,000.

Operating costs include resources, house management costs, maintenance, fixes, insurance, and house fees, but they banish capital expenditures and loan repayments. This variation is important since NOI stresses exclusively on the property' ;s working efficiency.

Why is NOI Essential?

NOI serves as a essential evaluate for analyzing a property' ;s economic performance and pinpointing places for improvement. By wearing down and knowledge detailed prices and revenue, home homeowners can gauge whether the property will be maintained effectively. A higher NOI usually indicates greater procedures, while a suffering NOI may signal underlying inefficiencies.

It is also a key aspect in calculating a property' ;s value. Investors usually use NOI to determine its capitalization charge (Cap Rate), which analyzes NOI to the property's market value. For example, if home provides $100,000 in NOI and has a market value of $1,000,000, its Limit Rate will be 10%. That relationship assists investors produce informed conclusions when comparing properties.

How May You Improve NOI ?

Increasing NOI involves actively increasing revenue or lowering running expenses. Here are strategies that can support:

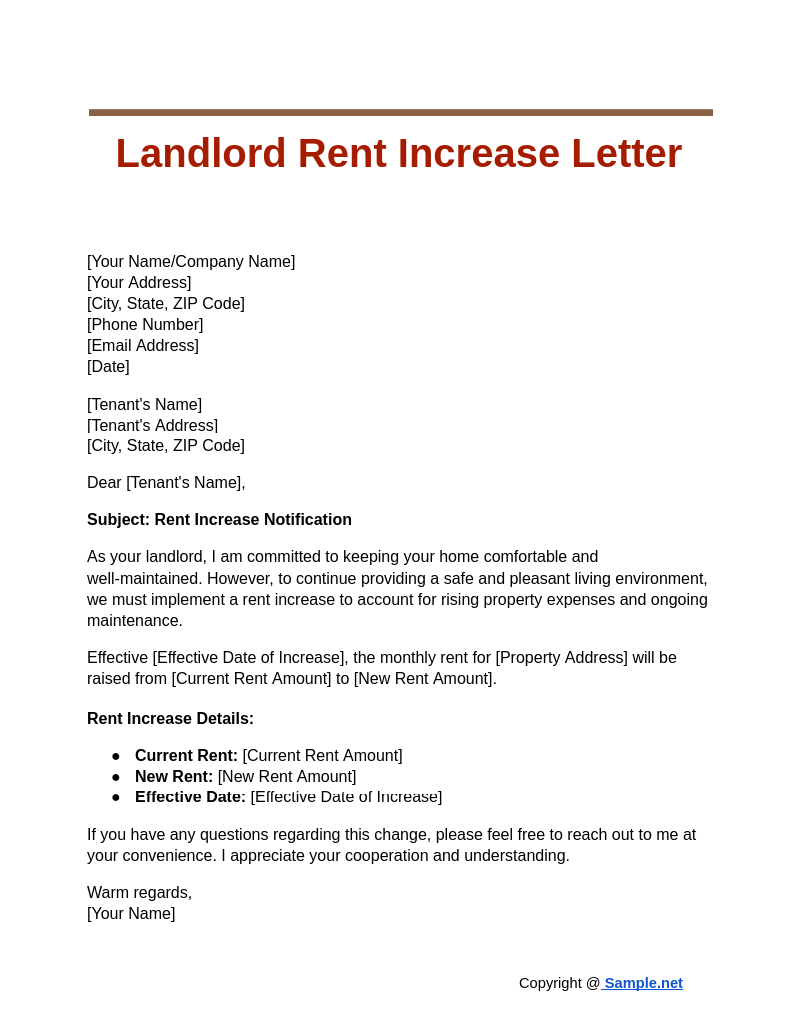

Raise Rental Money: You may change rental charges to align with industry traits or enhance the house by adding amenities, such as for example parking rooms or fitness stores, that justify higher rents.

Improve Occupancy Prices: Reducing vacancy rates by giving aggressive terms or incentives can considerably boost revenue.

Control Running Costs: Frequently auditing costs to get rid of spend or discussing better rates with support vendors can lower charges without diminishing quality.

NOI is not only lots; it shows the economic health of a house and provides as an instrument for decision-making. By concentrating on maximizing NOI , investors can enhance their returns and assure long-term price inside their real-estate portfolios.